This tutorial will show you how to change tax rates in PrestaShop

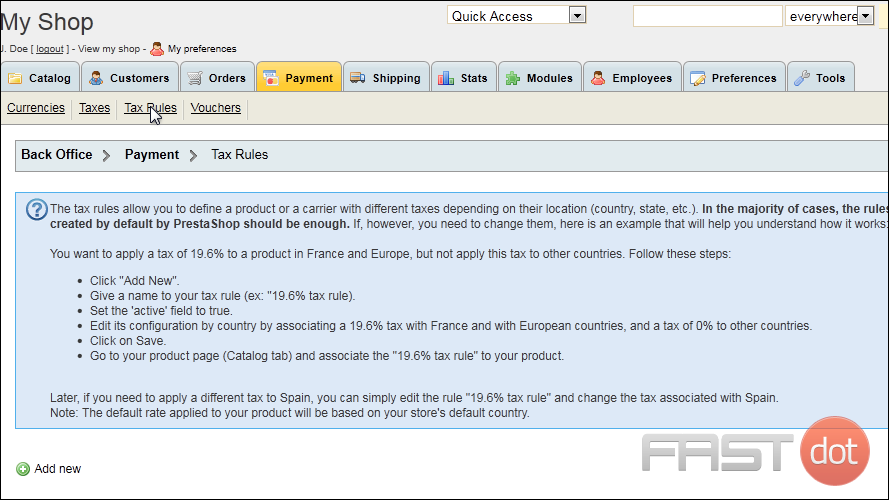

Setting up tax rules allows you to use different tax rates for different countries or states.

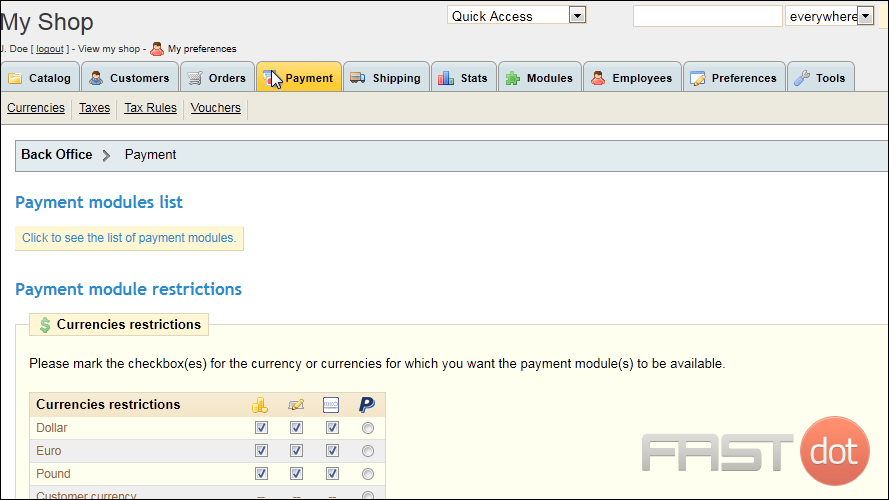

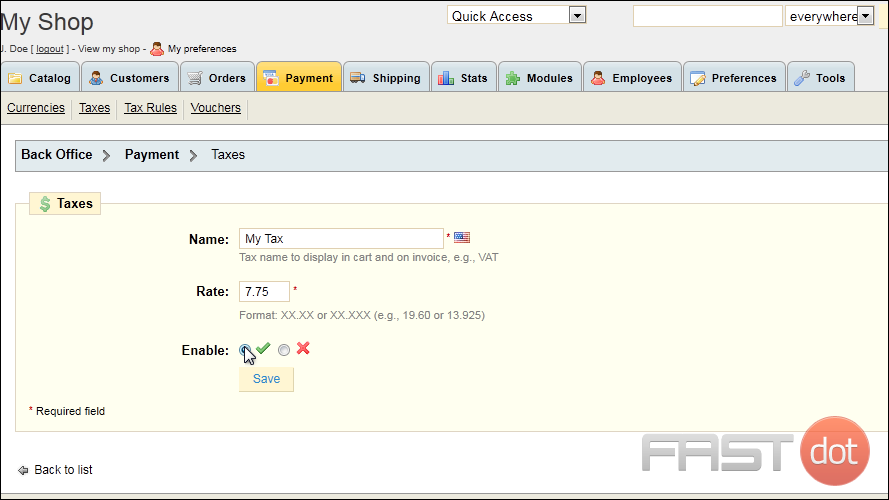

1) First, we have to set up a Tax Rate, so go to Payment.

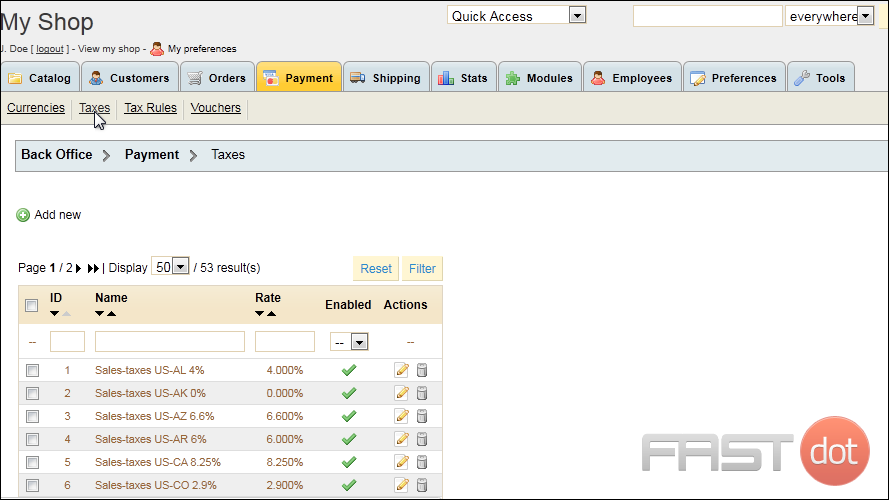

2) Click Taxes.

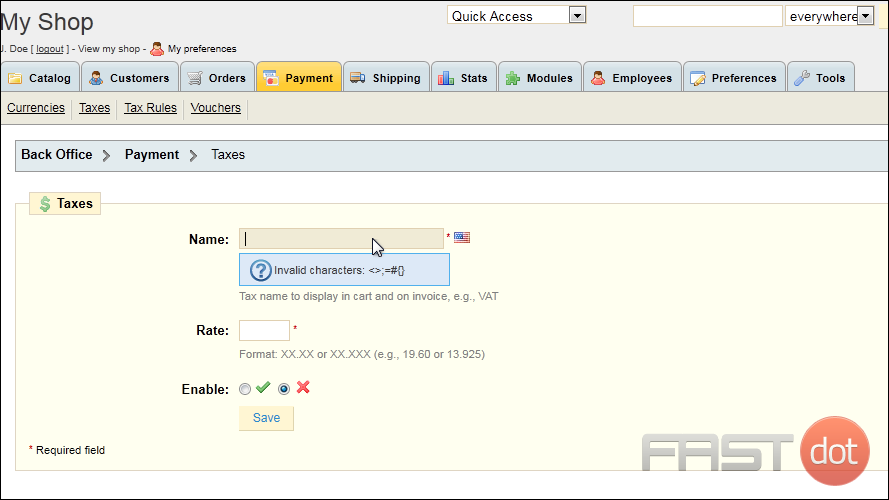

3) Click Add New.

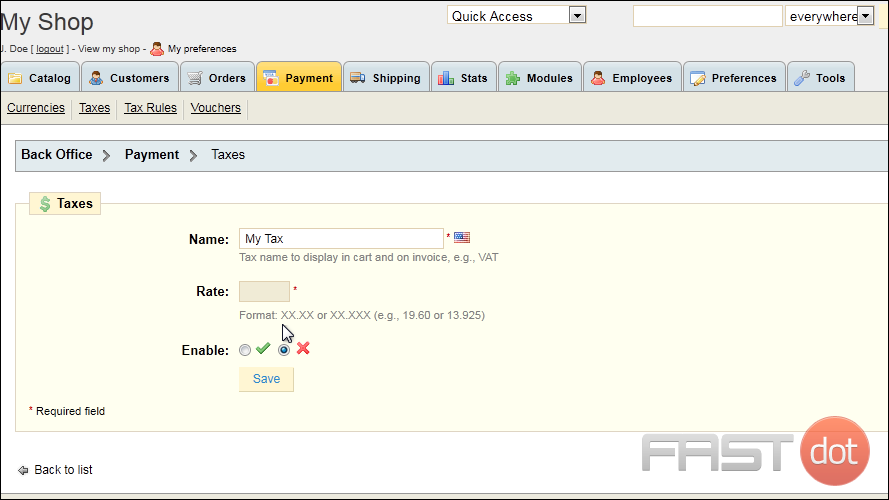

4) Enter a Name that will be shown in the customer’s cart and on their invoice.

5) Set the tax Rate.

6) Enable this tax rate if you want to use it.

7) Click Save.

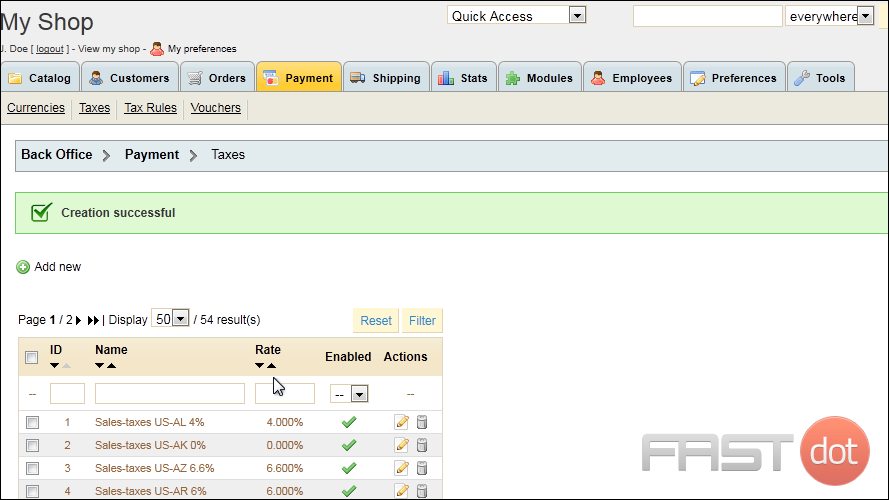

Now that we’ve set up our tax rate, we can apply it to specific countries or states.

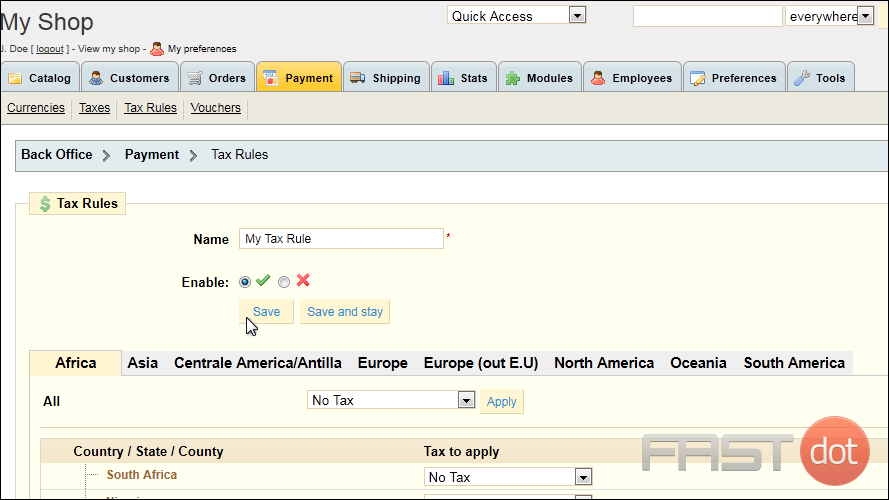

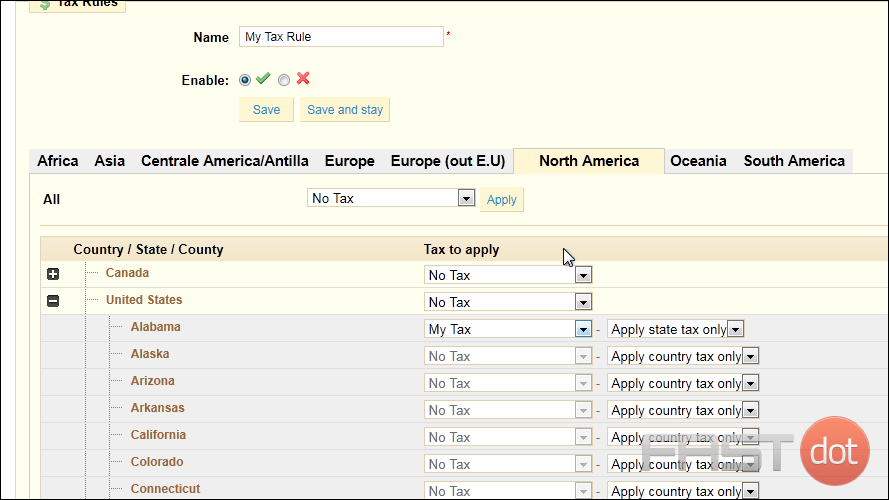

8) Click Tax Rules.

9) Click Add New.

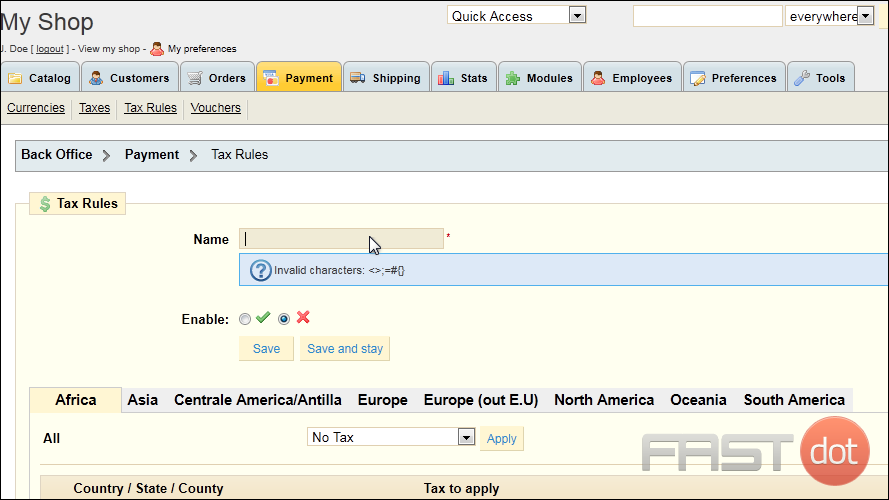

10) Enter a Name for this tax rule.

11) Enable this tax rule to make it active.

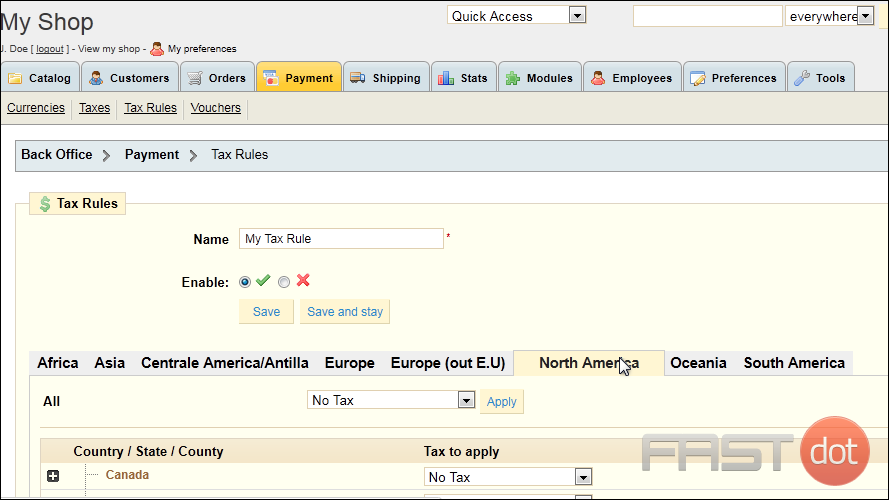

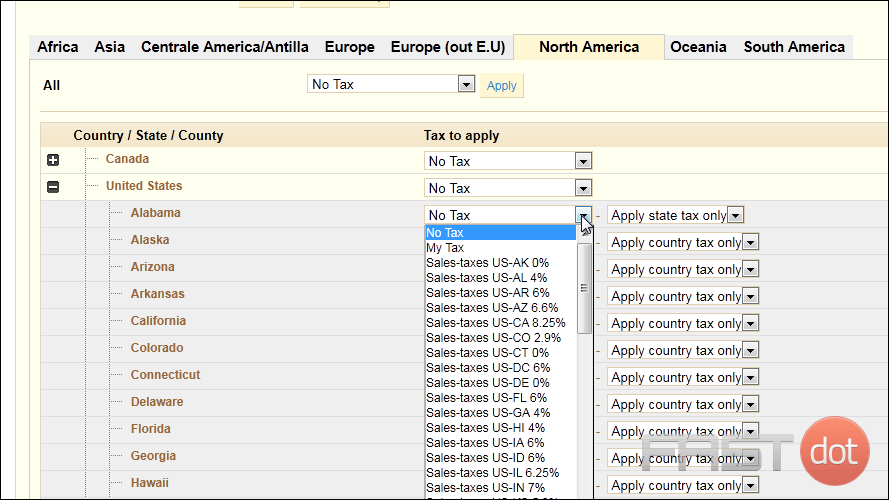

12) Select the continent where the country or state is located from these tabs at the top.

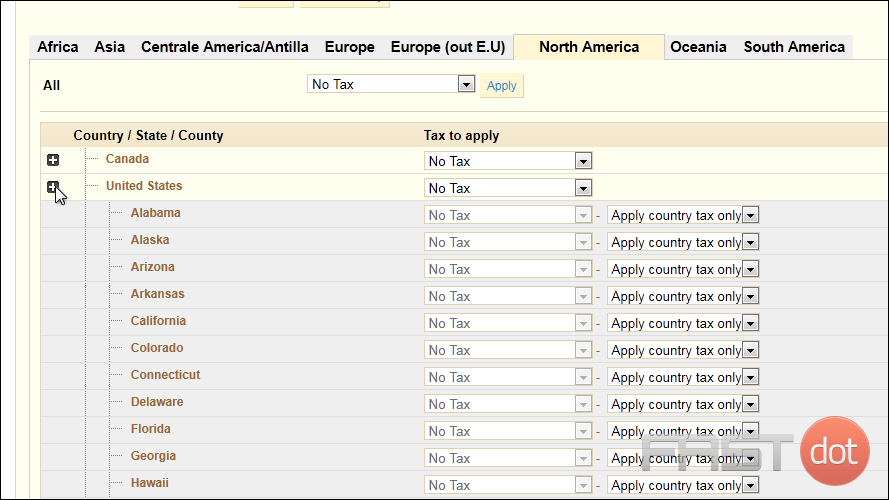

13) Click a plus sign to expand the list.

For each state, you can choose which tax to apply.

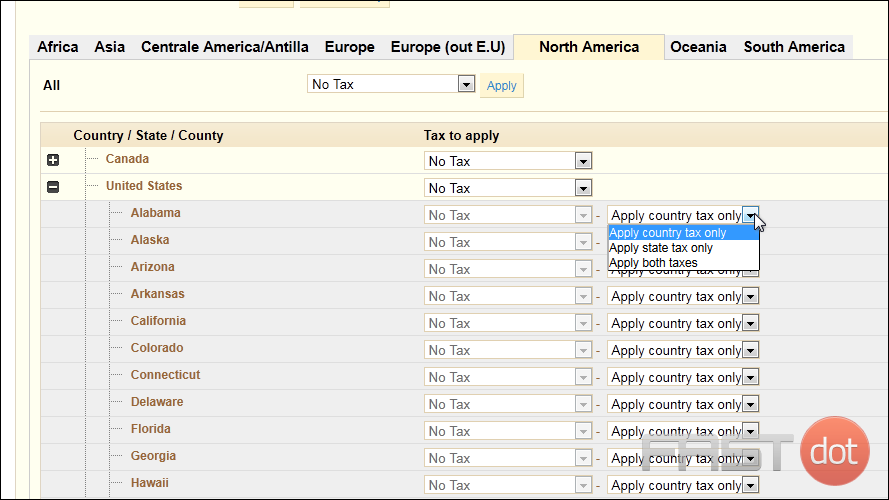

14) Choose to apply only country tax, only state tax, or both.

If you choose to apply state tax, you can then set the appropriate tax rate for that state.

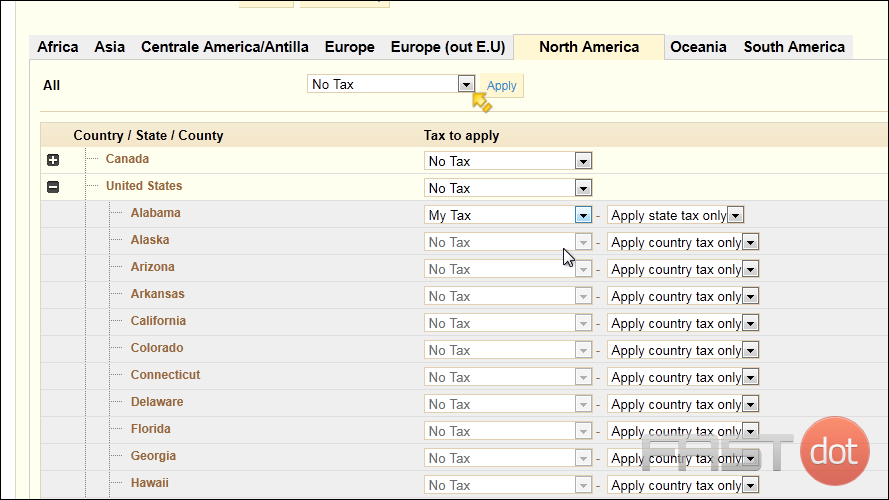

15) We’ll select the tax rate we created earlier.

Follow these steps to set a different tax rate for each country, state or county. Or you can set a tax rate for all areas by choosing it from this dropdown.

16) Click Save.

That’s it! Now you know how to setup tax rates in PrestaShop.

Do you have any questions? Ask us in the forums ?